Nigeria’s foreign reserves climbs to $34.7 billion as Naira gains

Nigeria’s foreign exchange reserves is now $34.7 billion, according to data obtained from the Central Bank of Nigeria’s website.

This is an increase of $110 million from Saturday July 6th figure of $34.5 billion.

The reserves have shown consistent growth over the past week, with a total gain of $316 million since July 1.

The rise over the past week is due to several factors, including the recent rise in oil prices, improved diaspora remittances, and the Central Bank’s efforts to stabilize the currency.

Meanwhile, the dollar supplied by willing buyers and willing sellers decreased by 32.64 percent to $116.88 million on Friday from $173.51 million recorded on Thursday.

The intraday high closed at N1,535 on Friday as against N1,550 closed on Thursday, while the intraday low was quoted at N1,450 on the same day compared to N1,430 quoted Thursday.

Analysts say that the forex reserves rise and naira gain may continue in the period ahead as inflows remain upbeat.

With the lingering crises in Middle East and Eastern Europe amid elevated oil demand, most analysts expect crude oil price to remain substantially above Nigeria’s budget benchmark of $77.96 per barrel.

The International Energy Agency (IEA), in its latest report, increased its global crude oil demand projection for 2024 by 1.3 million barrels per day (mbpd) to 103.2mbpd.

IEA estimated that extended output cuts by Organisation of the Petroleum Exporting Countries (OPEC) and its affiliates (OPEC+) would continue to moderate supply output, keeping off any major downside volatility.

OPEC+ members had extended their voluntary production cuts of 2.2mbpd into the second quarter of 2024, with expectation of further extension beyond the first half.

Economic Experts view the increase in foreign exchange reserves as a positive development for Nigeria’s economy, providing a buffer against external shocks and supporting the country’s ability to meet its financial obligations.

The Fitch Ratings agency recently revised Nigeria’s economic outlook to positive, citing significant reforms that have restored macroeconomic stability and enhanced policy coherence and credibility.

The Central Bank has also implemented various measures to manage the foreign exchange market, including the introduction of the Investors’ and Exporters’ window.

The initiative has helped in attracting foreign investment and boost reserves, leading to higher inflows to the official foreign exchange market and a significant rise in foreign portfolio investment inflows.

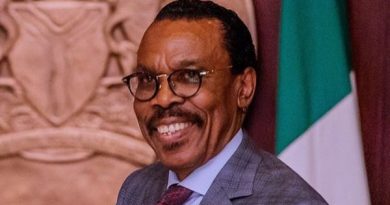

CBN Governor Olayemi Cardoso has outlined that ongoing efforts to strengthen the country’s forex position would lead to increased stability in forex reserves and naira.

According to him, the collaboration with Ministry of Finance and the NNPCL to ensure that all forex inflows are returned to the CBN will greatly enhance forex flows and contribute to the accretion of reserves.