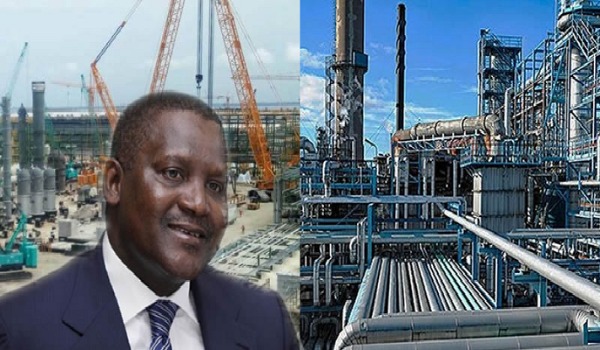

NNPC failing to supply feedstock to meet equity payment for Dangote refinery

Nigerian National Petroleum Company Limited (NNPC) has yet to supply Dangote refinery crude oil worth $1 billion, which is part of its payment obligation for the acquisition of 20 percent equity in the plant.

The state company is seeking to squeeze the crude oil out of domestic producers, which are now raising the alarm as such a strategy could risk further driving investors from the industry.

Since the 650,000-barrels-a-day Dangote refinery was commissioned in May, it has been idle, waiting for the supply of crude oil, and now NNPC must meet its crude supply obligation or risk losing part of its equity.

According to sources at the Ministry of Petroleum Resources in Abuja, Nigeria now runs the risk of losing a significant part of its equity in the Dangote refinery because of the failure to meet its obligations under which the equity acquisition was agreed.

Ronan Hodgson, an analyst at Facts Global Energy, was quoted as saying: “The refinery is likely to be started up in a phased fashion, with the crude distillation unit being the first unit,”

The consultancy expects several months of production of fuel oil and other lower-quality petroleum products, with Euro V — a reference to European emissions standards — petrol not forecast until the second half of next year.

“During the initial phase, yields will be highly dependent on feedstock choice,” said James McCullagh, executive director at Citac Africa Ltd., a firm specialising in the continent’s downstream oil industry. “But there will likely be exports of some straight-run products, namely fuel oil and naphtha.”

The facility is building up crude stocks in order to carry out test runs, but the start of commercial production remains unclear, according to two officials from NNPC who asked not to be identified.

While the plant should be able to run a full range of crude grades, its initial intake is expected to include major Nigerian streams such as Bonny Light, Forcados and Egina, the two officials said.

But denying, Devakumar Edwin, group executive director of Dangote Industries Ltd., was quoted as saying it would be incorrect to assert that a full ramp-up will take months, or that the first phase would entail mostly naphtha and fuel oil. “As the saying goes, the proof of the pudding is in the eating.”

The government equity in the refinery is costing a total of $2.7 billion, and this was meant to be paid by the federal government for the 20 percent equity. A payment mechanism was also agreed, with some in cash and some by way of crude oil supply.

Before now, NNPC has kept details of the transaction to its chest, and it has never disclosed to the Nigerian people the basis of the valuation.

Media report has it that as part payment for the 20 percent equity in the refinery, the Nigerian government has paid a cash f only $1 billion, which guarantees only about seven percent of the equity in the giant refinery built in Lekki, Lagos by Africa’s wealthiest billionaire Aliko Dangote.

Apart from the $1 billion payment, it was agreed that the NNPC will make available crude oil worth $1 billion to the refinery once it was completed while a balance of $700 million was meant to be paid through earned dividend from the operations of the plant.

It was reported earlier this month that the national oil company will supply the Dangote refinery with up to six cargoes of crude oil in December to be used in test runs.

In his speech at the refinery commissioning in May, Dangote said the plant will meet all of Nigeria’s refined products needs as well as the demand in the African market.

He said the company selected the best plants and equipment and the latest technologies from across the world.

“Our products slate is designed to meet the highest quality standards of high-value products including Premium Motor Spirit, Automotive Gas Oil (diesel), Aviation Turbine Kerosene; all of Euro V Standards that will enable us not only meet our country’s demand but also to become a key player in the African and global market,” he added.